Noi calculation formula free#

That's going to change the free cash flow after debt service which is not what we want to do. Still another may choose to leverage the property at 75% at a different mortgage rate. Another owner may choose to leverage the property up to 50% at one mortgage rate. One owner may choose to acquire property all for cash.

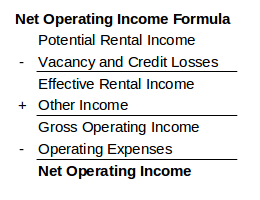

That's going to vary from owner to owner. The owner of the property decides what sort of debt they're going to place on the property. Debt service is not included in an operating expense because an operating expense has to do with the property itself - what is the property expending or spending to make sure the business runs smoothly. When we're talking about free cash flow, we're talking about debt service included. If you have a loan on the property, debt service is not included in the NOI. They include debt service like mortgage payments. There is a big mistake a lot of people make when calculating the NOI. So the NOI is really just telling us what the gross income is but subtracting the normal operating expenses. That’s the leftover money - the free cash flow of the property. That means the NOI of the property - the gross income - all the income we have coming in - minus all the operating expenses - is $500,000.

Let's say we have a property with a gross income of $1 million. But an operating expense is incurred in the normal course of doing business - repairs, maintenance costs, utilities, staffing, that sort of thing. That would be a capex or capital expenditure. We're increasing the value of that property so that would not fall under an operating expense. For example, let's say we are renovating the kitchen in a unit. So basically, any expense that the property incurs over the course of doing normal business.Ĭapital Expenses Are Not Operating ExpensesĪ capital expense is an improvement to the property.

Noi calculation formula plus#

Those items - plus a whole lot more - are going to come under gross income. Gross means everything, so gross income means every single dollar of income, whether through rents, late fees, laundry, and all the examples we mentioned above.

It doesn't matter how it's produced - it's going to fall under gross income. Rents (all the rent money that comes in)īasically, every single dollar of income produced by the property.What is gross income? With a multi-family property, we have: To understand NOI, we have to understand what gross income and operating expenses are - the two components in the formula. There is a formula that we use to calculate NOI - NOI = your gross income minus your operating expenses. In this blog post, I’m going to walk you through what NOI is and how you can correctly calculate it for your property. But there is a big mistake some people make when calculating NOI. Mastering the net operating income or NOI of a property is crucial to properly understanding underwriting and managing your real estate portfolio.

0 kommentar(er)

0 kommentar(er)